tax on forex trading in canada

I would group the forex commodities and stock in different grouping and just have one total for each group. Little Capital Gains Tax Forex Trading Canada over 80 in our test.

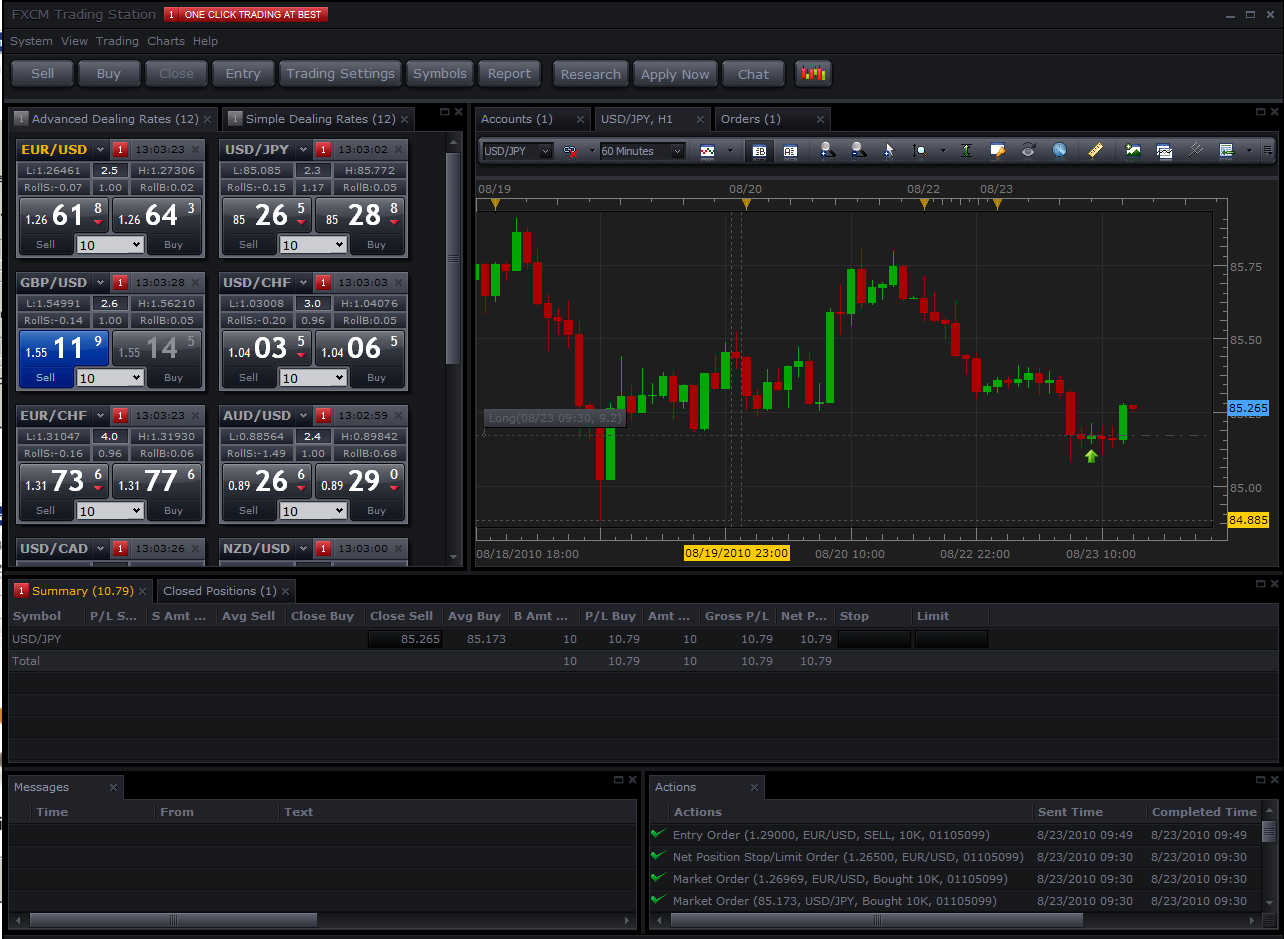

Best Forex Trading Platforms Canada 2022 Forexcanada Ca

If you are in the highest tax bracket you pay around 50 Consequently your tax on capital gains is 12 of 50 which is 25 for each dollar you make over 100K.

. For the average Canadian the taxable capital gain is determined by. Is Forex Trading Illegal In Canada. The losses from day trading are tax deductible against.

How Do I Report Day Trading On My Taxes In Canada. With some assets its pretty clear-cut as to whether they will be treated as income or capital gains. Canada Foreign exchange gains or losses from capital transactions of foreign currencies for Canadian citizens have the same 200 Foreign Tax Exemption.

Canadian tax laws on currency trading are another topic of interest. Your just have to keep your records incase CRA comes knocking. Canada permits the trading of currency.

Usually this means that 50 of the profit is taxed and the other. That isnt saying how its treated. You are a currency broker or trader.

Tax reporting on forex trading in Canada is straightforward. If you make less. Alberta has the tightest Forex regulation of any.

On the one hand if a traders only source of income is Forex trading and his or her annual earnings are at 12400 or lower then the market participant does not have to pay. This means 50 of your gains are taxed at your marginal tax rate. Canada has Day Trading TaxesUpon day trading income you are fully taxable in Canada as opposed to capital gains.

Currency markets tax. How is daytrading treated by CRA. Any income or salary earned is subject to capital gains tax and forex traders should be prepared to pay up to 50 on profits.

If youre an investor infrequent trades with long-term investing horizon youll treat any profits as a capital gain. Forex options and futures contracts are considered IRC Section 1256 contracts for tax purposes. Updated for tax year 2021.

Forex trading is legal in Alberta but may only be offered by brokers regulated in Alberta to professional or wealthy investors. It means that 60 of your. If currency trading is your livelihood CRA treats your gains as business income and they are 100 taxable.

Regulators at both national and local levels have a hand in overseeing the forex market in Canada. Unlike most countries where Forex profits are treated and taxed as income in Canada it is subject to Capital Gains tax. Given the nature of my trading patterns CRA will require me to claim my securities trading as business income on income.

The CRA says you treat it as capital gainslosses translated into Canadian dollars if the gain or loss is more than 200 CAD. Calculate income or losses in. You can open an account and start trading forex via.

Capital Gains Tax Forex Trading Canada. Capital gains taxable at 50 at your home tax rate apply to day trading income as there is no capital gain tax in Canada. When trading futures or options investors are effectively taxed at the maximum long-term capital gains rate or 20 on 60 of the gains or losses and the maximum short.

When you buy a security and sell it at a profit you realize a capital gain. Foreign exchange gains or losses from capital transactions of foreign currencies that is money are considered to be capital gains or losses. As such they are subject to a 6040 tax consideration.

Is Forex Trading Tax Free In Canada Ictsd Org

Is Forex Trading Legal In Canada Toshi Times

Best Forex Brokers For Beginners In Canada In 2022 Fee Comparison Included

Forex Trading Academy Best Educational Provider Axiory Global

What Is A Tax Ratio For Forex Trader In Canada Ictsd Org

Netnewsledger Forex Trading In Canada Why The Trend Is Growing

What Is A Tax Ratio For Forex Trader In Canada Ictsd Org

The 5 Best Trading Platforms In Canada In 2022 A Review

Best Forex Brokers In Canada For 2022 Investingoal

A Guide On Forex Time Canada Forex Canada

Forex Trading Academy Best Educational Provider Axiory Global

Solutions For Smart Traders And Investors Who Want To Pay Less Taxes

Do Forex Traders Pay Tax In Canada If Yes Then How Much Quora

Forex Trading Tax Canada How Are Trading Profits Taxed

Canada Provides Additional Guidance On Regulation Of Crypto Exchanges

Forex Trading Academy Best Educational Provider Axiory Global

Is Forex Income Taxable In Canada Ictsd Org

![]()

The Best Forex Trading Canada Forex Ca Reviewed Forex Brokers In Ca